What I’ve Learned From Budgeting for a Family of Four

Okay, here’s a long-form blog article based on your prompt:

Are you feeling overwhelmed by the sheer expense of raising a family? Do you stare at your bank account and wonder where all the money went, even though you swear you just got paid? Trust me, you’re not alone! Juggling the costs of housing, food, childcare, and everything else that comes with kids can feel like a never-ending uphill battle. But it doesn't have to be a constant source of stress. Over the years, I've learned a few tricks and developed some habits that have helped my family not only survive but thrive financially. It’s all about knowing where your money is going, making smart choices, and planning for the future. I'm going to share what’s worked for us, in hopes that it will help you gain control of your family finances.

My Family's Financial Journey: From Chaos to Control

Our family's financial journey wasn’t always smooth sailing. In fact, it started out pretty rocky. When we first started our family, budgeting wasn't even on our radar. We were young, making decent money, and figured things would just…work out. We ate out a lot, bought things on impulse, and didn’t really track where our money was going. Sound familiar?

Then came the reality check – kids! Suddenly, we weren't just paying for ourselves; we had diapers, formula (at least in the beginning!), doctor visits, and eventually, childcare expenses to contend with. Our carefree spending habits quickly became a source of anxiety. We knew something had to change. We needed to get serious about*family budgeting.

So, we dove in, headfirst. We tried everything from complicated spreadsheets to fancy budgeting apps. Some things worked, some things didn't, but through trial and error, we developed a system that works for us. It's not perfect, and it requires constant tweaking, but it gives us a sense of control and allows us to prioritize what’s truly important to our family. Now, let's break down the key things I've learned about effectivefamily budgeting, and hopefully something will resonate with you.

Practical Steps and Insights:Building a Budget That Works

The first, and most crucial, step is to understand where your money is actually going. You can’t fix a problem if you don’t know it exists, right?

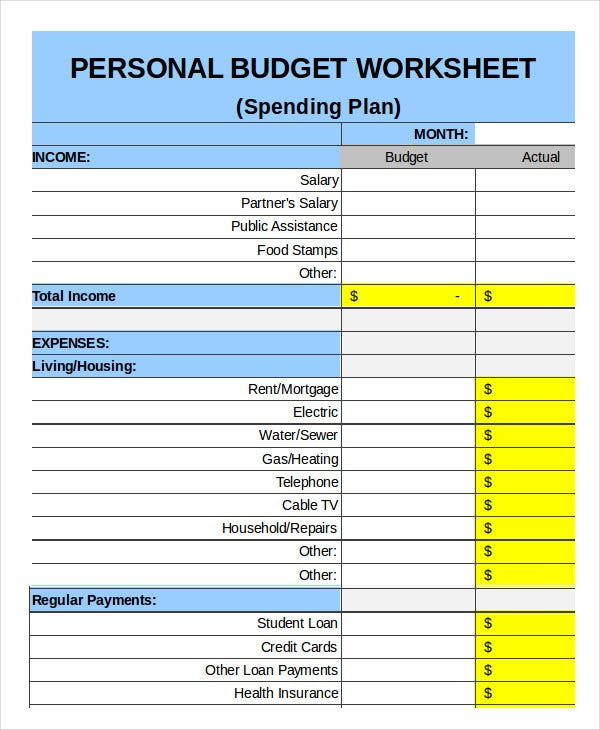

Track Everything: For at least a month, track every single expense. This includes the big things like rent/mortgage and car payments, but also the small things like that daily coffee or impulse buy at the grocery store checkout. You can use a budgeting app (there are tons of free ones!), a spreadsheet, or even a good old-fashioned notebook. The method doesn’t matter as much as the consistency.

Categorize Your Expenses: Once you have a month's worth of data, categorize your expenses into broad categories like housing, food, transportation, entertainment, childcare, and debt repayment. This will give you a clear picture of where your money is being allocated.

Create a Realistic Budget: Based on your income and expenses, create a budget that allocates your money to each category. Be realistic about your spending habits and adjust accordingly. Don't try to cut everything out at once; start small and gradually make changes. The aim isn't deprivation, but rather conscious allocation. Remember to include a category for savings and unexpected expenses – because lifewillthrow curveballs.

The Importance of Zero-Based Budgeting: A method that really resonated with me was zero-based budgeting. This means that every month, you allocate every single dollar you earn to a specific category. Your income minus your expenses should equal zero. It forces you to be intentional about where your money is going and prevents you from mindlessly spending.

Regularly Review and Adjust: Your budget isn't set in stone. Life changes, and your budget needs to adapt. Review your budget at least once a month (we do it weekly!) to see how you're doing and make adjustments as needed. Did you overspend in one category? Where can you cut back in the future? Did you come in under budget? Consider putting that extra money towards debt or savings.

Benefits and Outcomes: The Rewards of Budgeting

Budgeting for a family isn't just about cutting costs; it's about gaining control of your finances and creating a more secure future for your loved ones. Here are some of the benefits we’ve experienced: Reduced Stress and Anxiety:Knowing where your money is going and having a plan for the future significantly reduces financial stress and anxiety. No more late-night worrying about bills or wondering how you're going to make ends meet.

Increased Savings: Budgeting allows you to prioritize savings and build an emergency fund. This provides a financial cushion for unexpected expenses and allows you to pursue your long-term financial goals, like buying a home or funding your children's education.

Improved Financial Decision-Making: When you have a budget, you're forced to be more mindful of your spending habits and make more informed financial decisions. No more impulse buys or unnecessary expenses. You'll start to think about the long-term impact of your spending choices.

Stronger Family Relationships: Talking about money can be difficult, but budgeting together as a family can strengthen your relationships. It allows you to align your financial goals and work together towards a common purpose.

Reaching Goals: Once you have a handle on your finances, it's easier to set and reach your goals, whether that's a family vacation, paying off debt, or saving for retirement. A good budget makes these things much more attainable.

Common Problems and Solutions: Addressing Your Concerns

Here are some common questions or problems people face when budgeting, and how to approach them:Why is tracking expenses so important?

Tracking expenses is the foundation of any successful budget. Without knowing where your money is going, you can't identify areas where you can cut back or make more efficient spending choices. It provides a clear and objective picture of your financial habits, allowing you to make informed decisions about your money.

How do you start budgeting when you're living paycheck to paycheck?

It's tough, but not impossible. Start by focusing on the essentials: housing, food, transportation, and utilities. See where you can trim these costs. Look into programs that can help with food costs or utility assistance. Any extra money should go towards building a small emergency fund (even $500 can make a difference) so you can avoid debt when unexpected expenses arise. Find small ways to increase your income, like selling unwanted items or taking on a side hustle. The key is to be persistent and patient.

What if my partner and I have different spending habits?

This is a common challenge. Communication is key. Sit down together and discuss your financial goals and values. Find common ground and create a budget that reflects both of your priorities. Consider having separate "fun money" accounts that each of you can spend without needing to consult the other. This allows for individual spending freedom within the framework of a shared budget. It's also okay to seek help from a financial advisor if you're struggling to reach an agreement.

Real Life Tips and Tricks

Meal Planning is Your Friend: Seriously, meal planning has saved us so much money and reduced food waste. Take some time each week to plan out your meals and create a grocery list. Stick to the list when you go shopping to avoid impulse buys. Consider cooking in bulk and freezing leftovers for easy meals during busy weeknights.

Automate Savings: Set up automatic transfers from your checking account to your savings account each month. Even small amounts can add up over time. You can also automate bill payments to avoid late fees and keep your credit score healthy.

Embrace Free Entertainment: There are tons of free or low-cost activities you can enjoy with your family. Visit local parks, libraries, and museums. Have game nights or movie nights at home. Get creative and find ways to have fun without breaking the bank.

Shop Around for Insurance: Review your insurance policies (car, home, life) regularly and shop around for the best rates. You might be surprised at how much you can save.

Say Goodbye to Debt: High-interest debt can drain your finances. Prioritize paying off debt as quickly as possible. Consider using the debt snowball or debt avalanche method to stay motivated.

It takes effort and it takes time. Be patient and celebrate the small wins along the way.

Conclusion: Taking Control of Your Family's Financial Future

Budgeting for a family of four (or any size!) can feel daunting, but it's an essential step towards financial security and peace of mind. By tracking your expenses, creating a realistic budget, and making smart financial choices, you can gain control of your finances and create a brighter future for your family. Remember, it's not about depriving yourself, but about prioritizing what's truly important and making conscious spending decisions. Start small, be patient, and don't be afraid to ask for help. You've got this! Take that first step today, and see how much more in control of your finances you’ll feel. What are you waiting for?

Posting Komentar untuk "What I’ve Learned From Budgeting for a Family of Four"